Find claim payment information

Claim Payments tab to find payment detail including who was paid, when and how, adjustment information and other payment information.

Only paid (P status) claims will have complete payment information. Claims that are in process, pended, being audited, or claims that have been released won't have complete information.

Access the Claim Payments tab

- Search for and open the claim.

-

Select the

Claim Paymentsoption from theClaimmenu, located in the session pane.

At the top of the window, the Stop Loss indicator shows if the claim check was submitted to a stop-loss carrier and the Special Handling field tells you if a special delivery was required for the payment (for example, overnight).

Update Stop Loss and Special Handling

If you have the required permissions to update these fields, follow the instructions below. See Manage Special Handling Codes for more information on the list of available codes.

- Select

YesorNofrom theStop Losslist. - Use the

Special Handlinglist to select one of the following codes or other codes specified for your check/EOB EOBs are sent to members and payees to inform them of the disposition of claims. Typically an EOB identifies the date and type of service, the billed amount, deductibles, co-insurance, and an explanation of any ineligible charges. An EOB can also be a helpful tool in identifying fraudulent claims, as the member receives notification even when payment is made to the provider. An EOB isn't a bill. process.

EOBs are sent to members and payees to inform them of the disposition of claims. Typically an EOB identifies the date and type of service, the billed amount, deductibles, co-insurance, and an explanation of any ineligible charges. An EOB can also be a helpful tool in identifying fraudulent claims, as the member receives notification even when payment is made to the provider. An EOB isn't a bill. process.00—US Mail.

01—FedEx Overnight.

02—UPS Overnight.

03—UPS Ground.

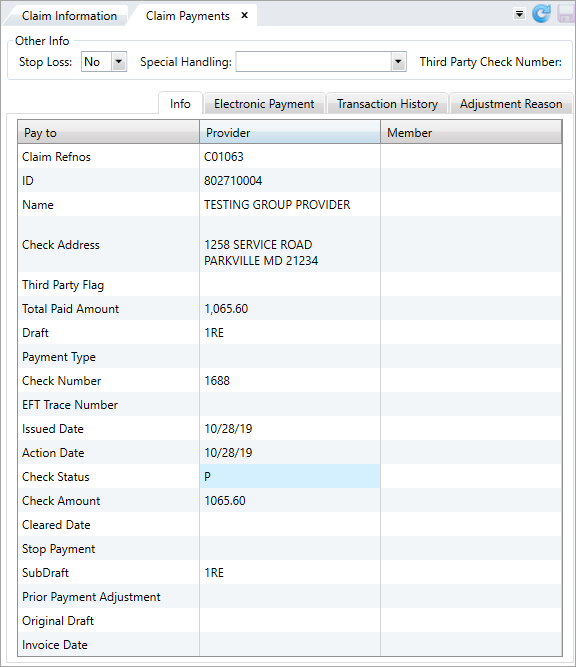

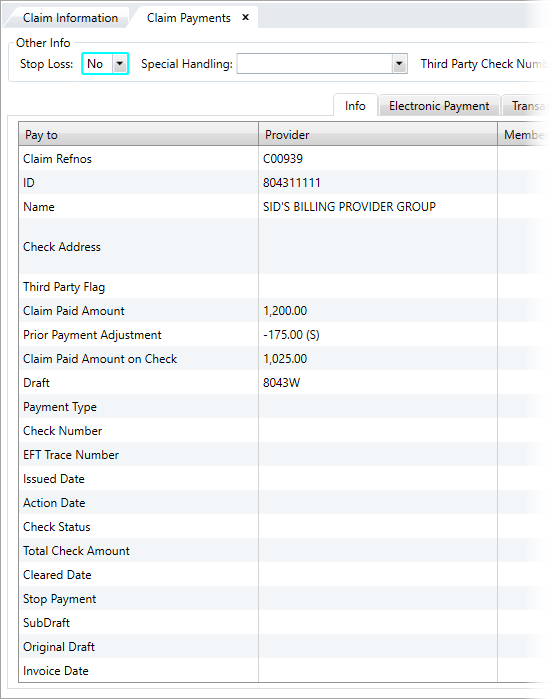

The Info tab lists all the payment information related to the claim. The columns identify the payee—provider, member, or other party—and contains the payment information for that payee.

If the payment is to the provider, you'll see the billing provider ID and name in the Provider column. Likewise, if the payment is to the member, you'll see the member ID and name in the Member column.

| Field | Description |

|---|---|

| Claim Refnos | A unique alphanumeric claim identifier associated with the check. |

| ID | Social security number for members or tax ID# for providers. |

| Name | Name for whoever the claim check is issued to. |

| Check Address | The address the claim check is sent. |

| Third Party Flag | Y indicates the payment was issued to a third party, rather than the member. |

| Claim Paid Amount |

Amount specified on the check. |

| Prior Payment Adjustment |

Amount carried forward from a prior claim as an adjustment to the total amount paid for a claim. The amount could be negative or positive based on over or underpayments on the prior claims. If the payment adjustment was taken at the billing provider level, |

| Draft | Draft code associated with the claims check. Draft on which the claim check was issued. |

| Payment Type |

How the payment was delivered.

|

| Check Number | Check number used to pay this claim. |

| EFT Trace Number | Number that identifies the completed claims check. |

| Issued Date | Date the check was originally issued. |

| Action Date | Date the claims check was run. Defaults to the current date. The only time the action and issued date might be different is when the check is voided. |

| Check Status |

Current status of the check, which includes:

|

| Total Check Amount |

Paid amount on the check. |

| Cleared Date | Date the claim check was cleared by the bank. |

| Stop Payment | Y indicates a stop payment was put on the check. |

| SubDraft | Identifies the sub-accounts that share a host draft. A host draft defines the overall banking arrangement for a specific checking account. |

| Original Draft | Original draft associated with the claim. |

| Invoice Date | Date the invoice file was received from the trading partner. |

- Claims with a status other than

Pwill either be blank or have incomplete information. See Claim statuses for more information. - If the claim has been adjusted, the reason code for the adjustment displays next to the status.

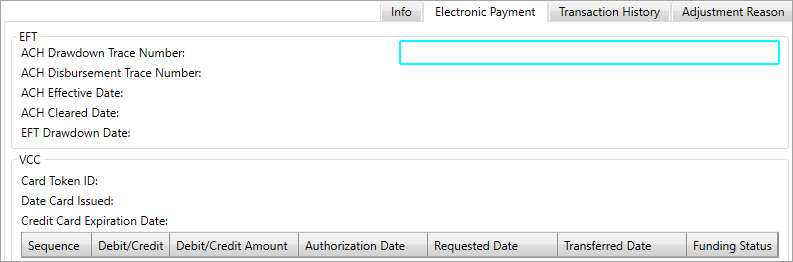

The Electronic Payment subtab contains Electronic Funds Transfer (EFT) information and Virtual Credit Card (VCC) information.

| Field | Description |

|---|---|

| ACH Drawdown Trace Number | A unique number assigned to the ACH |

| ACH Disbursement Trace Number | A unique number assigned to the ACH |

| ACH Effective Date | Date the EFT ACH |

| ACH Cleared Date | Date the EFT |

| EFT Drawdown Date | Date the EFT funds were pulled from the payer's bank account. |

| Card Token ID | Virtual Credit Card (VCC) unique ID which replaces the check number. |

| Date Card Issued | Date Virtual Credit Card (VCC) was issued. |

| Credit Card Expiration Date |

Virtual Credit Card (VCC) expiration date. |

| Sequence | Sequence number for the electronic payment. |

| Debit/Credit | The transaction is either a debit (+) or a credit (-). |

| Debit/Credit Amount | Amount debited or credited on the Virtual Credit Card (VCC) transaction. |

| Authorization Date | Date the funds were authorized to be transferred from the payer's account. The format is YYYYMMDD. |

| Requested Date |

Date the funds were requested from the payer's account by the payment processor. The format is YYYYMMDD. |

| Transferred Date |

Date the funds were transferred from the payer's account by the payment processor. The format is YYYYMMDD. |

| Funding Status | Status indicating that the funds to the payment processor completed the transfer. |

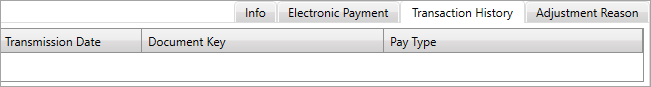

The Transaction History subtab contains claim’s print vendor transaction information, if applicable.

| Field | Description |

|---|---|

| Transmission Date | Date the print vendor transmitted the file. |

| Document Key |

Key used to link print vendor file transactions (Emdeon, RedCard, etc.)

|

| Pay Type |

How the payment was delivered to the payee. This could be paper check, ACH |

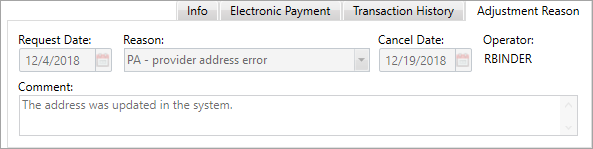

To track why, and when an adjustment is done on a paid (claim status—P) trading partner (BCBS, Anthem, UHC, etc.) claim, view the Adjustment Reason tab. You must have the proper access to view this tab. See Find a trading partner claim’s adjustment reason for details.